Content

Mastering ROI: Understanding the roi def & Maximizing Business Value

Every business, big or small, aims to grow and succeed. Understanding how your investments pay off is key to this success. Return on Investment, or ROI, is a powerful tool that helps you measure this. This guide will walk you through what ROI is, why it matters, and how you can use it to make smarter business choices. By the end, you will have a comprehensive understanding of how to maximize your business value.

What is ROI? Defining Return on Investment

Businesses constantly make investments.

These investments can be in new equipment, marketing campaigns, or even employee training.

Knowing if these investments are profitable is crucial.

ROI helps you see the direct financial impact of these decisions.

Studies show that data-driven organizations are 23 times more likely to acquire customers, six times as likely to retain customers, and 19 times as likely to be profitable. Understanding the roi def is the first step towards becoming such an organization, transforming raw data into actionable insights that directly impact your bottom line. It's the compass guiding businesses toward sustainable growth and profitability.

The Fundamental roi def: A Simple Explanation

The roi def explains a ratio that compares the gain or loss from an investment relative to its cost.

It helps you understand the efficiency of an investment.

You calculate it by dividing the net profit of an investment by its initial cost.

This simple number tells you how much money you made for every dollar you spent.

For example, if you invest $100 and gain $150, your net profit is $50, and your ROI is 50%.

Why the roi def Matters for Every Business Decision

The roi def is more than just a number; it is a vital metric for strategic planning.

It allows businesses to compare different investment opportunities.

You can decide where to put your money for the best returns.

This understanding helps in allocating resources wisely across various projects.

It ensures that every financial commitment aligns with your profitability goals.

For instance, when evaluating a new product launch, the roi def helps you project potential profits against development and marketing costs. Similarly, deciding on a major software upgrade requires understanding how it will improve efficiency or revenue to justify the investment. Without this clarity, businesses risk making costly errors based on guesswork rather than data. It provides the financial rationale for every strategic move.

Differentiating ROI from Other Financial Metrics

Many financial terms exist, and it is easy to confuse them.

ROI stands apart from metrics like profit margin or payback period.

Profit margin shows how much profit a company makes from its sales.

Payback period tells you how long it takes to recover an initial investment.

Each metric offers a unique perspective on financial health.

| Metric | What It Measures | Why It's Different from ROI |

|---|---|---|

| ROI | The efficiency of an investment | Focuses on return relative to cost, across various investments. |

| Profit Margin | Profit earned per dollar of sales | Measures profitability of sales, not necessarily an investment's return. |

| Payback Period | Time to recover initial investment cost | Focuses on time, not the total return percentage. |

| Net Present Value (NPV) | The current value of future cash flows | Accounts for time value of money, more complex than simple ROI. |

The Importance of ROI in Business Strategy

ROI is not just a calculation; it is a cornerstone of smart business strategy.

It guides your decisions and helps you see the real impact of your efforts.

Using ROI ensures you are always moving towards greater profitability.

This metric empowers you to make data-driven choices.

Driving Informed Decision-Making with a Clear roi def

A clear understanding of the roi def empowers leaders to make better choices.

It helps you prioritize projects that offer the highest returns.

You can quickly identify underperforming areas and adjust your strategies.

This ensures that every dollar spent contributes to your business goals.

It minimizes wasted resources and maximizes potential gains.

Measuring Project Success and Accountability

ROI provides a clear benchmark for project success.

It holds teams accountable for the financial outcomes of their initiatives.

You can track progress and make adjustments if a project is not meeting its targets.

This fosters a culture of efficiency and results.

It encourages a focus on measurable outcomes.

Attracting Investors and Demonstrating Value

Investors look for businesses that can generate strong returns.

A high ROI demonstrates your company's ability to create value.

It signals financial health and growth potential to potential funders.

Presenting solid ROI figures can significantly boost your appeal to investors.

It shows a clear path to profitability.

Step-by-Step Guide to Calculating ROI

Calculating ROI is straightforward once you understand its components.

This simple formula can unlock powerful insights for your business.

Follow these steps to accurately measure your investment returns.

It helps you see the true impact of your financial decisions.

Identifying Initial Investment and Net Profit

First, identify your initial investment.

This includes all costs associated with the investment, such as purchase price, installation, and training.

Next, determine the net profit, which is the revenue generated from the investment minus its operating costs.

For example, if you invest in a new machine, the investment includes its price, setup fees, and any necessary training for staff.

The net profit would be the extra income or savings the machine brings in, minus its running costs.

Incorporating calculating asset value into ROI Formulas

When calculating asset value for ROI, consider both the initial cost and any depreciation or appreciation over time.

For long-term assets like buildings or major machinery, their value can change, impacting the overall return.

Properly calculating asset value ensures your ROI reflects the true financial picture.

This step is crucial for accurate long-term investment analysis, providing a more complete view of your assets' contribution to profit.

It helps you avoid overstating or understating your returns.

When considering fixed assets, remember that depreciation can significantly affect your net profit over time. For example, a machine purchased for $50,000 might depreciate by $5,000 annually. This depreciation needs to be factored into your operating costs to get an accurate roi def over the asset's lifespan. For a deeper dive into asset valuation, consider resources like Investopedia's guide on asset valuation, ensuring all costs are accounted for.

Practical Examples of ROI Calculation

Let's look at some real-world examples.

Imagine you invest $10,000 in a marketing campaign.

This campaign generates $15,000 in new sales revenue, with $2,000 in additional costs.

Your net profit is $15,000 - $2,000 = $13,000.

The ROI would then be ($13,000 / $10,000) * 100% = 130%. This shows a very effective campaign.

| Investment Type | Initial Investment | Revenue Generated | Additional Costs | Net Profit (Revenue - Costs) | ROI Formula (Net Profit / Initial Investment) | Calculated ROI |

|---|---|---|---|---|---|---|

| Marketing Campaign | $10,000 | $15,000 | $2,000 | $13,000 | $13,000 / $10,000 | 130% |

| New Equipment | $50,000 | $75,000 | $10,000 | $65,000 | $65,000 / $50,000 | 130% |

| Employee Training | $5,000 | $8,000 | $1,000 | $7,000 | $7,000 / $5,000 | 140% |

Different Types of ROI and Their Applications

ROI is a versatile metric, adaptable to various business areas.

Understanding its different forms helps you apply it correctly.

Each type focuses on specific aspects of investment returns.

This broad applicability makes ROI incredibly valuable.

Marketing ROI: Measuring Campaign Effectiveness

Marketing ROI measures the profitability of your marketing efforts.

It helps you see which campaigns are truly effective.

You can calculate it by dividing the sales growth attributable to marketing by the marketing spend.

This allows you to optimize your marketing budget for better results.

For instance, a social media campaign generating $50,000 in sales for a $10,000 cost has a strong marketing ROI.

To truly optimize marketing ROI, consider implementing A/B testing for your campaigns. By testing different headlines, images, or calls to action, you can identify what resonates most with your audience, leading to higher conversion rates and a better return on your ad spend. Tools like Google Analytics and various marketing automation platforms offer robust features for tracking campaign performance and attributing revenue, making it easier to pinpoint your most profitable channels and improve your overall roi def.

Social ROI: Quantifying Intangible Benefits

Social ROI is harder to quantify but equally important.

It measures the return from investments in social good, like community programs or employee well-being.

While direct financial gain might not be immediate, benefits like improved brand reputation or employee morale contribute to long-term value.

You might use surveys or brand sentiment analysis to gauge this return.

Measuring employee satisfaction after a wellness program is one way to assess social ROI.

Financial ROI: Assessing Investment Performance

Financial ROI is the most traditional form, used for assessing financial investments.

This includes stocks, bonds, or real estate.

It focuses purely on the monetary gain relative to the initial financial outlay.

Investors use it to compare different financial instruments and make portfolio decisions.

A real estate investor might calculate financial ROI on a rental property to see its profitability.

Limitations and Best Practices for ROI Analysis

While powerful, ROI has its limitations.

Relying solely on ROI can sometimes lead to incomplete decisions.

Understanding these pitfalls is crucial for accurate analysis.

Always consider ROI as one piece of a larger puzzle.

Common Pitfalls and Misinterpretations of the roi def

One common pitfall is ignoring the time value of money.

A high ROI over a long period might be less attractive than a moderate ROI over a short period.

Another issue is not including all costs, which can inflate the perceived roi def.

Be sure to account for all direct and indirect expenses, like administrative overhead or maintenance.

Failing to consider qualitative factors is also a mistake, as some benefits are not easily monetized.

When Not to Rely Solely on ROI

ROI doesn't always capture the full picture.

Some investments, like brand building or research and development, have long-term or intangible benefits not immediately reflected in ROI.

You should also consider strategic importance, risk, and alignment with company values.

Sometimes, an investment with a lower ROI is strategically vital for future growth.

For example, investing in a new compliance system might have low ROI but prevents huge fines.

Consider the example of investing in cybersecurity. While it might not generate direct revenue, a robust cybersecurity infrastructure protects your company from potentially devastating data breaches, which can cost millions in fines, reputation damage, and lost business. The roi def for such an investment is not about profit generation, but about risk mitigation and long-term business continuity. Sometimes, the best investment is one that prevents significant loss rather than generating immediate gain.

Enhancing ROI Analysis for Accurate Insights

To get the most out of ROI, combine it with other metrics.

Consider the project's risk profile and its strategic fit.

Use consistent calculation methods across all projects for fair comparison.

Regularly review and update your ROI calculations.

This holistic approach provides a more robust understanding of your investments.

| Best Practice | Description | Benefit |

|---|---|---|

| Include All Costs | Account for direct, indirect, and opportunity costs. | Ensures a realistic and accurate ROI figure. |

| Consider Time Horizon | Evaluate ROI over appropriate timeframes (short vs. long-term). | Prevents misjudgment of investment efficiency. |

| Combine with Other Metrics | Use ROI alongside NPV, Payback Period, or qualitative factors. | Provides a holistic view of investment performance. |

| Standardize Calculation | Use consistent formulas and assumptions across all projects. | Allows for fair and meaningful comparisons between investments. |

| Regular Review | Periodically re-evaluate ROI as conditions change. | Helps in making timely adjustments and optimizing outcomes. |

Strategies to Optimize and Improve Your ROI

Improving your ROI is a continuous process.

It involves looking at both sides of the equation: costs and revenues.

Smart strategies can significantly boost your returns.

Focus on efficiency and value creation.

Optimizing your roi def isn't just about cutting costs; it's about making every dollar work harder. This involves a strategic approach to both expenditure and revenue generation. Key principles include:

- Strategic Resource Allocation: Directing funds to projects with the highest potential returns.

- Process Optimization: Streamlining workflows to reduce waste and improve output.

- Customer Value Enhancement: Focusing on delivering superior value to drive repeat business and higher average transaction values.

- Innovation Investment: Allocating resources to R&D that can unlock new revenue streams or efficiencies.

By adopting these principles, businesses can systematically enhance their return on investment.

Cost Reduction and Efficiency Improvements

Reducing costs directly impacts your ROI.

Look for ways to streamline operations and eliminate waste.

Negotiate better deals with suppliers or automate repetitive tasks.

Every dollar saved on expenses increases your net profit.

Implementing energy-efficient lighting, for example, can reduce utility bills and boost ROI.

Revenue Growth and Value Creation

Increasing revenue is another powerful way to boost ROI.

This can involve expanding your customer base or introducing new products.

Focus on delivering exceptional value to your customers.

Higher sales, coupled with managed costs, lead to better returns.

Offering premium services or entering new markets can drive significant revenue growth.

Continuous Monitoring and Adjustment

ROI is not a one-time calculation.

Regularly monitor your investments and their performance.

Be ready to adjust your strategies based on new data.

This agile approach ensures you are always optimizing for the best possible return.

Set up dashboards to track key metrics and review them often.

Conclusion

Understanding the roi def is fundamental for any business aiming for sustainable growth.

It provides a clear, quantifiable measure of your investment's success.

By mastering ROI, you empower yourself to make informed decisions.

This leads to greater profitability and long-term business value.

Keep calculating, analyzing, and optimizing for success.

How does ROI help when choosing new business software, like AI tools?

ROI helps you pick new software.

It shows if a tool is a good buy.

Consider tools like CVShelf and its AI-powered features.

It saves time for hiring teams.

For instance, an AI-driven platform can drastically improve HR ROI. By automating resume screening and intelligently shortlisting candidates, it reduces the time-to-hire and the cost-per-hire. For example, if a recruiter spends 10 hours manually reviewing resumes for one role, and an AI tool reduces that to 1 hour, the 9 hours saved per role directly translate to cost savings and faster talent acquisition, allowing recruiters to focus on strategic tasks. This efficiency is a clear measure of positive roi def in HR.

Less time spent means more profit for you.

What does a "good" ROI look like, and how can I set realistic expectations?

A "good" ROI changes by industry.

Some aim for 10%, others want 50%.

Check what is common for your field.

Higher risk often needs higher ROI.

Your business goals also define success.

Can ROI be negative? What should I do if my ROI is negative?

Yes, ROI can be negative.

This means you lost money on an investment.

A negative roi def shows a financial loss.

First, check all your costs and earnings.

Then, find out why it failed and fix it.

How can I improve my ROI without just cutting costs?

You can boost ROI by making more money.

Also, create more value for customers.

Here are some simple ways:

- Make customers very happy.

- Sell new products people want.

- Train your staff better.

- Get more sales from leads.

These steps help your business grow.

How does ROI apply to human resources, especially with tools for hiring?

ROI helps HR measure hiring success.

Tools like CVShelf save time.

They cut costs in finding new staff.

When calculating ROI for hiring, consider the time saved.

A good HR ROI means smart hiring choices.

How useful was this post?

Click on a star to rate it!

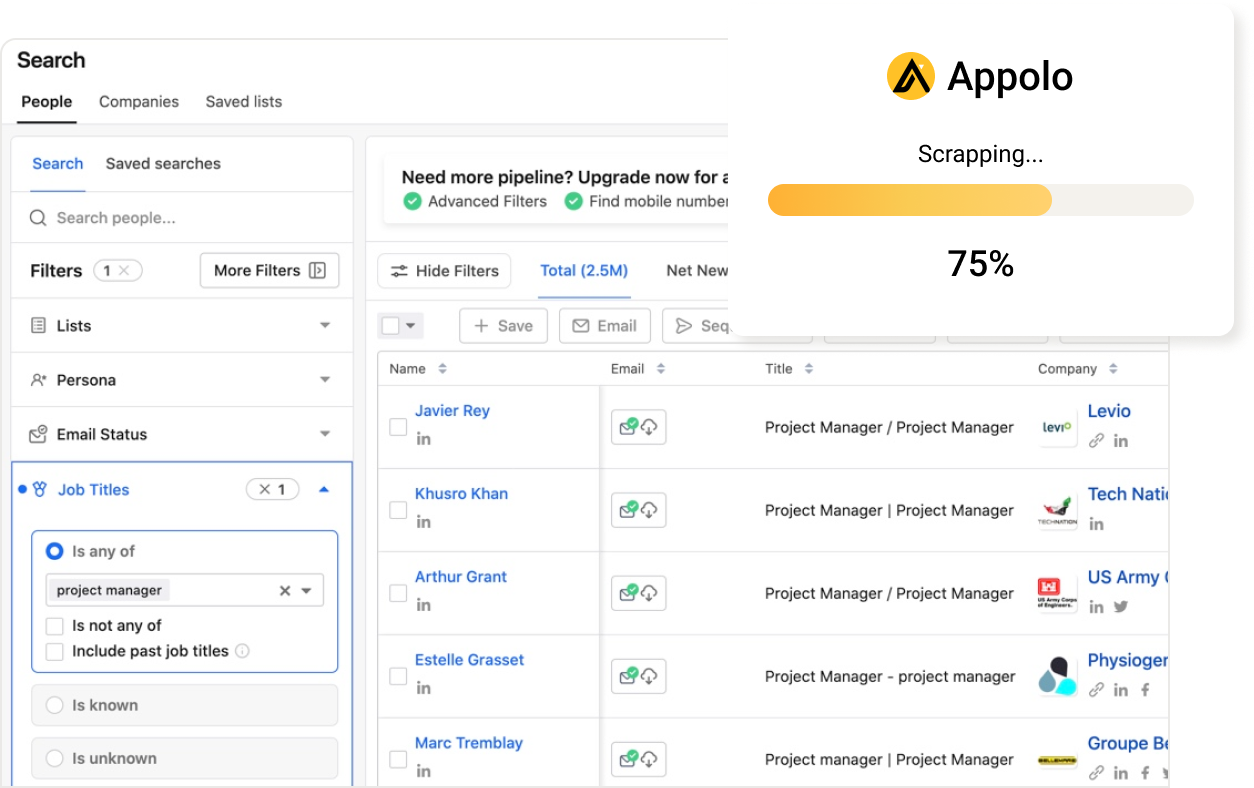

Export Leads from

Sales Navigator, Apollo, Linkedin