Content

Is Deferred Income an Asset? Unpacking This Key Financial Concept

Many people wonder about complex financial terms.

Understanding concepts like deferred income is very important for financial literacy.

This article will clarify what deferred income truly is.

We will also explore its true nature and classification in accounting practices.

Understanding Deferred Income: A Foundational Overview

Deferred income is a common financial concept found across many industries.

It plays a significant role in how companies accurately report their earnings over time.

Let's break down what this term means in simple, understandable language.

We will look at how it comes about from everyday business transactions.

What is Deferred Income and How Does It Arise?

Deferred income refers to money a company receives upfront from customers.

This money is for goods or services it has not yet delivered or performed.

Think of it as an advance payment or a pre-payment for future work.

The company now has a clear obligation to provide a future service or product to the customer.

Common Scenarios Leading to Deferred Income

Several common business activities consistently create deferred income.

Subscriptions for software or magazines are prime examples for many businesses.

Customers often pay for a full year of service in advance, such as an annual software license fee.

Annual memberships, pre-paid consulting services, and even gift cards also generate this type of income.

These scenarios are particularly prevalent in the rapidly expanding subscription economy. For instance, Software-as-a-Service (SaaS) companies frequently receive annual or multi-year payments upfront for their services, which they then recognize as revenue over the subscription period. According to a report by Zuora, the subscription economy has grown by more than 435% over the last decade, highlighting how common deferred income has become across various industries. This growth underscores the importance of understanding how these upfront payments are accounted for.

The Purpose of Deferring Revenue

Companies defer revenue to accurately match income with the period it is actually earned.

This practice strictly follows the accrual accounting principle, a core financial rule.

It ensures financial statements accurately reflect a company's true performance over time.

This method provides a clearer and more reliable picture of a company's true earnings.

Beyond mere compliance, deferring revenue offers critical insights for both internal management and external stakeholders. It allows companies to forecast future earnings more accurately, manage cash flow effectively, and make informed strategic decisions. For investors, a consistent and growing deferred income balance can signal strong customer loyalty and predictable future revenue streams, making the company an attractive investment. This transparency helps in understanding the true operational health, rather than just immediate cash inflows.

Is Deferred Income an Asset? Clarifying a Common Misconception

Many people mistakenly believe deferred income is an asset on a company's books.

This is a very common misunderstanding in the world of business finance.

It is crucial to understand its actual classification on financial statements for proper analysis.

Let's clarify its true nature and position on the balance sheet.

Why Deferred Income is Primarily a Liability

Deferred income is not an asset; it is fundamentally a liability for the company.

A company has an obligation to provide future goods or services to the customer who paid.

This obligation means the company owes something valuable to its customers in the future.

Until the service is delivered, the cash received is considered a debt or an unearned amount.

The Journey from Deferred Income to Earned Revenue

Deferred income transforms from a liability into earned revenue over a specific period.

As the company delivers the service or product, it earns the revenue gradually.

The liability then decreases on the company's balance sheet, reflecting the fulfilled obligation.

The earned amount moves to the income statement as recognized revenue, boosting sales figures.

Addressing the Question: Is Deferred Income an Asset in Any Scenario?

The direct answer is no, deferred income is an asset in no scenario.

However, the cash received from deferred income is indeed an asset for the company.

This cash sits in the company's bank account, ready for use in operations or investments.

It is important to distinguish between the cash itself and the future service obligation.

To clarify further, consider a simple analogy: if you pay a contractor upfront for a home renovation project that will take several months, the contractor receives the cash (an asset). However, until they complete the work, that money is considered deferred income on their books – it's a liability because they owe you the completed renovation. Only as they finish each stage of the project do they 'earn' that portion of the income. This fundamental principle helps answer the question, is deferred income an asset, by emphasizing the obligation over the immediate cash receipt.

Accounting Treatment and Financial Reporting of Deferred Income

Properly accounting for deferred income is essential for all businesses.

It impacts a company's financial statements significantly and directly affects reported figures.

Understanding its treatment helps analysts and investors gauge a company's true financial health.

Let's look at how it appears in various crucial financial reports.

Recording Deferred Income on the Balance Sheet

Deferred income appears on the balance sheet as a current liability.

It is often listed under names like "unearned revenue" or "customer deposits" by companies.

This clearly shows the company's obligation to its customers for future delivery of goods or services.

The liability decreases as services are rendered over time, moving to the income statement.

Impact of Deferred Income on the Income Statement

Deferred income does not appear on the income statement at the initial receipt of cash.

Only when the service is delivered or the product provided does it become earned revenue for the company.

This earned revenue then boosts the company's top line, its total sales or service income.

It directly contributes to reported profits and overall financial performance metrics.

How Deferred Income Affects Cash Flow

Deferred income positively impacts a company's immediate cash flow.

The cash is received upfront, significantly improving the company's liquidity position.

This cash inflow is recorded in the operating activities section of the cash flow statement.

It provides immediate funds for business operations, investments, or debt repayment.

Effective management of the cash received from deferred income is crucial. Companies can strategically deploy these funds for various purposes, such as investing in product development, expanding market reach, or even bolstering their human resources capabilities, perhaps by investing in platforms like CVShelf to streamline recruitment. However, financial discipline is key; these funds must be managed with the understanding that they represent future obligations, ensuring the company can fulfill its promises to customers without liquidity issues.

Table 1: Deferred Income Flow and Financial Statement Impact

| Stage | Balance Sheet Impact | Income Statement Impact | Cash Flow Impact |

|---|---|---|---|

| Cash Received (Upfront) | Deferred Income (Liability) increases; Cash (Asset) increases | No immediate impact on revenue recognition | Cash Inflow from Operating Activities (Positive) |

| Service Delivered Over Time | Deferred Income (Liability) decreases as obligation is met | Revenue increases (recognized as earned) | No direct cash flow impact at this stage (already received) |

Deferred Income in Relation to Net Assets and Other Metrics

Understanding deferred income helps evaluate a company's overall financial standing.

It relates to broader financial metrics that paint a picture of a company's health.

Let's explore its connection to net assets and how it influences company worth.

We will also differentiate it from other important financial concepts and valuations.

Understanding "What Does Net Assets Mean" in Context of Deferred Income

What does net assets mean refers to the total assets minus total liabilities of a company.

Deferred income, being a liability, directly reduces a company's calculated net assets.

A higher deferred income balance means more future obligations for the business to fulfill.

This can impact how investors and creditors view a company's overall financial strength and stability.

How Deferred Income Differs from Stock Net Asset Value

Deferred income is distinct from stock net asset value, which is a different metric.

Stock net asset value (NAV) typically applies to investment funds or mutual funds, not operating companies.

It represents the value of a fund's assets minus its liabilities, calculated on a per-share basis.

Deferred income is a company-specific operational liability, not a per-share fund valuation metric.

The Role of Fair Market Value of Stock in Financial Analysis

The fair market value of stock is the price at which a company's stock trades on an open market.

This market value is influenced by many factors, including a company's liabilities like deferred income.

A large and growing deferred income balance might indicate strong future revenue potential.

However, it also highlights significant future obligations that the company must fulfill to its customers.

Table 2: Key Financial Terms and Their Relation to Deferred Income

| Term | Definition | Relation to Deferred Income |

|---|---|---|

| is deferred income an asset | A common question; it is a liability, not an asset. | Directly addresses the core topic of this article, clarifying its nature. |

| what is net asset | Total assets minus total liabilities; also known as equity or book value. | Deferred income (a liability) reduces a company's net assets, impacting equity. |

| define base pay | The fixed salary or hourly wage paid to an employee, excluding bonuses or commissions. | No direct relation to deferred income; a human resources and compensation term. |

| definition of mrr | Monthly Recurring Revenue; predictable revenue from subscriptions or ongoing services. | MRR often generates deferred income, as subscriptions are frequently paid upfront for periods. |

What is Net Asset vs. Net Value Asset?

The term what is net asset is often used interchangeably with net value asset in financial discussions.

Both phrases generally refer to the equity of a company or an individual's total wealth.

This is what remains after subtracting total liabilities from total assets on a balance sheet.

Deferred income directly impacts this calculation, as it is a significant liability for many businesses.

Strategic Implications and Best Practices for Deferred Income

Managing deferred income effectively is crucial for any business's long-term financial health.

It provides valuable insights into future performance and the predictability of revenue streams.

Companies should adopt robust best practices for handling and reporting it accurately.

This ensures accurate financial reporting and builds strong confidence among investors and stakeholders.

Analyzing a Company's Financial Health Through Deferred Income

A growing deferred income balance can signal strong customer demand for products or services.

It shows customers are willing to pay upfront for future services, indicating trust and value.

However, it also means the company has significant future delivery obligations that must be met.

Analysts often look at the trend of deferred income over time to gauge underlying business health and growth.

A prime example of a company with significant deferred income is Adobe Inc., a leading software company. Due to its subscription-based creative and document software (like Photoshop and Acrobat), Adobe consistently reports billions in deferred revenue. For instance, in its Q4 2023 earnings, Adobe reported a substantial deferred revenue balance, indicating strong customer commitments and a predictable stream of future earnings. This trend is a key indicator for investors, signaling robust demand for their services and a healthy, recurring revenue model, reinforcing why understanding is deferred income an asset (or liability) is so important.

Investor Insights: What Deferred Income Balances Reveal

Investors pay close attention to deferred income balances when reviewing financial reports.

It can indicate future revenue predictability, which is highly valued in business models.

A healthy and consistently growing balance suggests a strong business model with loyal customers.

It also shows customer loyalty and trust in the company's offerings and future delivery capabilities.

Best Practices for Managing and Reporting Deferred Income

Companies should use robust accounting systems to accurately track deferred income balances.

Accurate tracking of service delivery and proper revenue recognition is vital for compliance.

Regular reconciliation of deferred income accounts is necessary to ensure financial accuracy.

Transparency in financial reporting builds trust with stakeholders and potential investors.

Table 3: Common Questions About Deferred Income

| Question | Simple Answer |

|---|---|

| Is deferred income cash? | Yes, the initial receipt is cash, but the income itself is not yet earned. |

| Does deferred income affect profit? | Not immediately; it affects profit only when the revenue is earned and recognized. |

| Is it good to have high deferred income? | Generally yes, as it indicates strong future revenue and customer trust, but also future obligations. |

Tips for Managing Deferred Income:

- Implement clear and consistent policies for recognizing revenue over time.

- Automate tracking of subscriptions, memberships, and service delivery to reduce errors.

- Perform regular audits of deferred revenue accounts to ensure accuracy and compliance.

- Communicate deferred income trends clearly in financial statements and investor reports.

- Consult with financial experts or use reliable accounting software for complex deferred revenue scenarios.

For more in-depth understanding of financial concepts, including deferred revenue, consider exploring resources such as Investopedia and AccountingTools. These resources provide comprehensive definitions and explanations. Additionally, for those looking to streamline their financial processes, especially in relation to revenue recognition, consider exploring accounting software solutions like Xero or QuickBooks, which offer features to automate and simplify the tracking of deferred income and its impact on financial statements.

Key Takeaways on Deferred Income:

- Deferred income is an asset: FALSE. It is always a liability, representing an unfulfilled obligation.

- Cash vs. Income: The cash received upfront is an asset, but the income itself is not earned until delivery.

- Impact on Net Assets: As a liability, deferred income reduces a company's calculated net assets.

- Future Revenue Indicator: A growing deferred income balance often signals strong future revenue potential and customer trust.

- Strategic Importance: Proper accounting and analysis of deferred income are vital for accurate financial reporting and investor confidence.

Conclusion:

Understanding whether is deferred income an asset or a liability is fundamental for anyone analyzing financial statements.

It is clearly a liability, representing future obligations a company must fulfill to its customers.

This financial concept is vital for accurate financial analysis, business valuation, and strategic planning.

Proper management and transparent reporting ensure a company's financial health and builds trust with all stakeholders.

Frequently Asked Questions About Deferred Income

Here are some common questions people ask about deferred income.

We provide clear and simple answers to help you understand this financial concept better.

These insights will help you grasp its importance in business accounting.

Understanding these terms is key for anyone looking at company finances.

Is deferred income really a liability, or can is deferred income an asset in some cases?

No, deferred income is an asset in no scenario.

It is always a liability on a company's balance sheet.

This is because it represents money received for services or goods not yet delivered.

The company has a clear obligation to provide something in the future.

How does deferred income affect a company's overall financial picture, especially when considering what does net assets mean?

When you consider what does net assets mean, deferred income directly impacts this calculation.

Net assets are a company's total assets minus its total liabilities.

Since deferred income is a liability, a higher balance reduces the company's net assets.

This shows that the company has more future obligations to fulfill for its customers.

How is deferred income different from concepts like stock net asset value or the fair market value of stock?

Deferred income is very different from stock net asset value.

Stock net asset value usually refers to the value of an investment fund's assets per share, not an operating company's liability.

Similarly, the fair market value of stock is the price at which a company's shares trade in the market.

While deferred income can indirectly influence investor perception, it is not a valuation metric for shares itself.

Can you explain the relationship between definition of mrr and deferred income for businesses?

The definition of mrr, or Monthly Recurring Revenue, often ties closely with deferred income.

Many businesses, especially software companies, collect MRR payments upfront for a full year or quarter.

When customers pay for these subscriptions in advance, the company records the unearned portion as deferred income.

As each month of service is provided, a portion of that deferred income becomes recognized MRR.

What is the difference between what is net asset and net value asset in relation to deferred income?

The terms what is net asset and net value asset are generally used interchangeably.

Both refer to a company's equity, which is its total assets minus its total liabilities.

Deferred income is a liability, so it directly reduces this net asset or net value asset figure.

Understanding this helps you see a company's true financial position after accounting for all its obligations.

Why is it important to define base pay separately from understanding deferred income?

It is important to define base pay as it relates to employee compensation, not company revenue.

Base pay is the fixed salary or hourly wage an employee earns, excluding bonuses or commissions.

This concept is entirely unrelated to deferred income, which is about unearned revenue from customers.

They are distinct financial terms used in different areas of business operations and accounting.

For more insights into financial concepts and efficient business operations, consider exploring resources like Investopedia or AccountingTools. For those seeking to streamline financial processes, consider exploring accounting software solutions such as Xero or QuickBooks.

How useful was this post?

Click on a star to rate it!

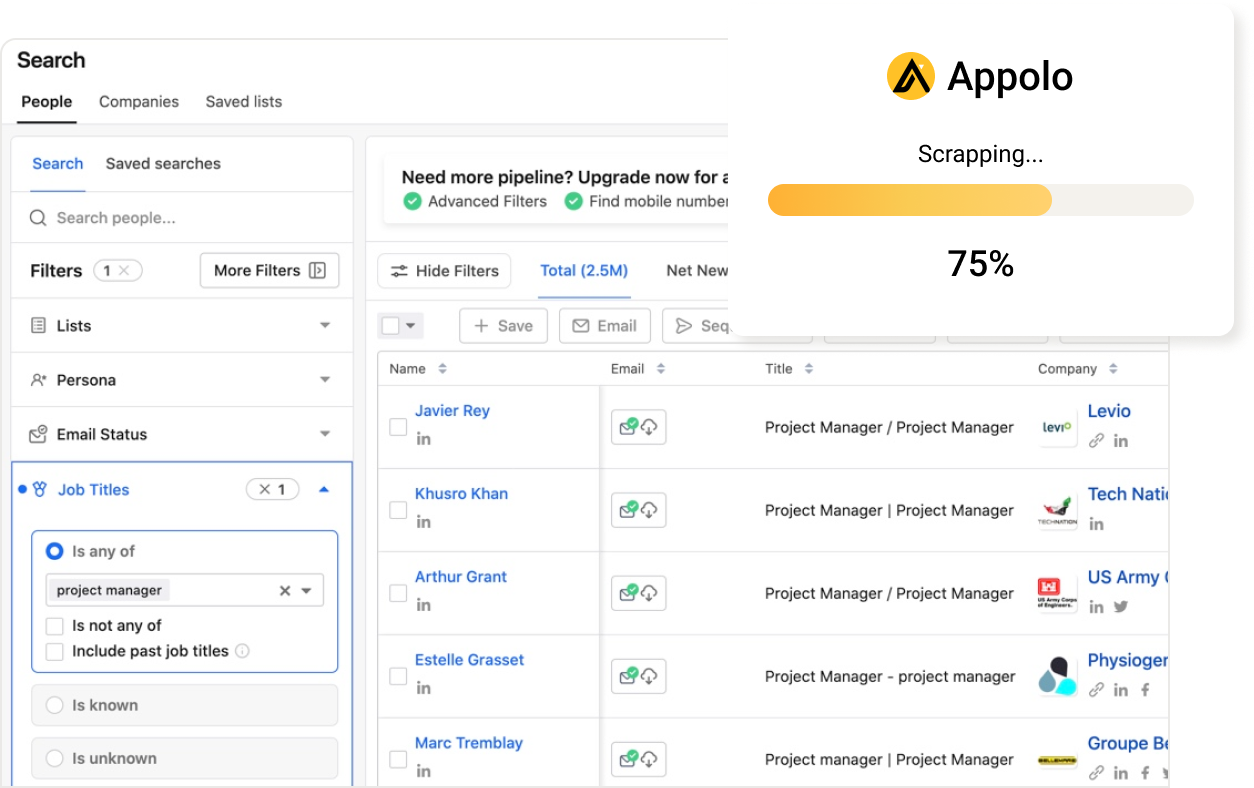

Export Leads from

Sales Navigator, Apollo, Linkedin