Content

Mastering FMV: How to Determine FMV Accurately

Understanding an asset's true worth is vital in many parts of life. This includes buying a home or valuing a business. Fair Market Value (FMV) is a core concept in this process. It helps ensure fair dealings for everyone involved.

This guide will show you how to determine FMV with confidence. We will explore its definitions, methods, and real-world uses. You will learn practical steps to assess value accurately.

In today's dynamic market, the precision of FMV is more critical than ever. According to a recent report by PwC, over 60% of all M&A transactions rely heavily on accurate asset valuations to ensure fair deals and regulatory compliance. Whether you're a first-time homebuyer or a seasoned investor, knowing how to determine FMV empowers you to make financially sound decisions, avoiding both overpayments and undervaluation.

Understanding the Definition of Fair Market Value (FMV)

What is Fair Market Value? A Core Definition

Fair Market Value (FMV) is the price an asset would sell for. It is the price in an open and competitive market. Both buyer and seller must be willing and knowledgeable. Neither can be under pressure to buy or sell.

This concept assumes a transaction between unrelated parties. It reflects a true meeting of minds on value. The definition of fair market value is crucial for many financial and legal needs.

Consider a classic car. Its definition of fair market value would be the price it fetches when sold by a collector to another collector, both having full knowledge of its condition and market trends, with no pressure. This differs from a "distress sale price" where the seller needs quick cash, or a "replacement cost" which is simply what it would cost to build a similar car from scratch. FMV captures the true equilibrium of supply and demand for that specific asset.

Differentiating FMV from Other Pricing Concepts (e.g., unique selling price definition, fair market price)

FMV is not the only term for value, but it is distinct. For instance, a unique selling price definition focuses on a product's special feature. This feature makes it stand out from competitors. It highlights what makes an item desirable to a specific buyer.

The term fair market price is often used interchangeably with FMV. However, FMV specifically implies an arm's-length transaction. It considers a broader market context. Other prices might reflect a quick sale or a distressed situation.

Why is Determining FMV Crucial?

Knowing how to determine FMV is essential for many reasons. It impacts taxation, ensuring you pay the right amount. It is key for estate planning, helping distribute assets fairly.

FMV also plays a big role in business sales and mergers. It sets a baseline for negotiations. This helps avoid disputes and ensures legal compliance.

Key Factors Influencing How to Determine FMV

Market Conditions and Economic Indicators

The overall economy greatly affects FMV. Strong economies often mean higher asset values. Weak ones can lead to lower prices.

Interest rates, inflation, and consumer confidence also play a part. These factors shape supply and demand. They directly influence what buyers are willing to pay.

To effectively determine FMV, keep an eye on these key economic indicators:

- Interest Rates: Higher rates can reduce borrowing power, impacting real estate and large asset values.

- Inflation: Can erode purchasing power but also increase the cost of replacing assets.

- Consumer Confidence: Directly affects demand for goods and services, influencing business valuations.

- Unemployment Rates: A strong job market often correlates with higher consumer spending and asset values.

Monitoring these helps you understand the broader economic climate affecting asset prices.

Asset Specifics: Condition, Age, and Scarcity

The physical state of an asset is very important. A well-maintained item usually has a higher FMV. Older items might have lower value unless they are antiques.

Scarcity can also boost value. Rare items often command higher prices. Unique features or limited availability make them more desirable.

Buyer and Seller Motivations and Negotiation Dynamics

The reasons a buyer or seller acts can influence the final price. A seller needing quick cash might accept less. A buyer with urgent needs might pay more.

However, FMV assumes no undue pressure. It reflects a typical transaction. Skilled negotiation can affect the final sale price, but FMV is the theoretical ideal.

Proven Methods and Approaches for Determining Fair Market Value

Valuation experts use several methods to calculate FMV. Each approach suits different types of assets. Combining methods often gives the most accurate result.

Understanding these techniques is key for knowing how to determine FMV. Let's look at the main ones.

The Sales Comparison Approach: Using Comparables

This method looks at recent sales of similar assets. It is widely used in real estate. You find properties that are much like yours.

Then, you adjust for differences like size or features. This approach provides a strong market-based estimate. It relies on good data about past transactions.

Tips for Sales Comparison:

- Always use recent sales data.

- Look for properties in the same area.

- Adjust for differences like upgrades or damage.

- Consider the market conditions at the time of sale.

Beyond real estate, the sales comparison approach is versatile. For example, when valuing a vintage comic book, an expert would research recent auction results for comics of the same issue, grade, and rarity. Adjustments would be made for subtle differences like cover condition or original print run. This direct market evidence is often the most compelling way to determine how to determine FMV for unique collectibles.

The Income Approach: Discounted Cash Flow and Capitalization

This method values an asset based on its future income. It is common for businesses and rental properties. You estimate the income the asset will generate.

Then, you discount these future earnings to a present value. This accounts for the time value of money. The capitalization method also converts future income into a current value.

The Cost Approach: Replacement and Reproduction Costs

The cost approach determines FMV by estimating the cost to replace or reproduce an asset. This method is often used for new construction. It is also useful for unique or specialized properties.

You calculate what it would cost to build a similar new asset. Then, you subtract depreciation for wear and tear. This gives you an estimated current value.

Summary of Valuation Approaches:

| Approach | Description | Best For |

|---|---|---|

| Sales Comparison | Compares to recent sales of similar items. | Real Estate, Vehicles, Collectibles |

| Income | Values based on future income potential. | Businesses, Rental Properties |

| Cost | Estimates cost to replace or reproduce. | New Construction, Specialized Assets |

Practical Applications and Real-World Examples of FMV

FMV in Real Estate and Business Valuation

In real estate, FMV guides home sales and mortgage lending. Banks rely on appraisals to ensure the loan amount matches the property's worth. For businesses, FMV is key during mergers or acquisitions. It helps set a fair purchase price for the company.

It also helps in valuing shares for private companies. This ensures fair treatment for shareholders. Knowing how to determine FMV here prevents overpaying or underselling.

In business valuation, FMV is crucial not just for the entire company, but also for specific assets within it. For instance, valuing a tech startup might involve assessing its intellectual property, customer base, and even its human capital. While valuing human capital directly for FMV is complex, understanding the market value of key talent can influence a buyer's perception of a company's worth during an acquisition. This is where tools that analyze talent pools and market compensation indirectly support the broader valuation process.

Determining FMV for Estate Planning and Taxation

When someone passes away, their assets need valuation for probate. The IRS requires FMV for estate tax purposes. Gifts also need to be valued at FMV for gift tax calculations.

This ensures proper tax reporting. It also helps in fair distribution among heirs. Accurate FMV avoids future legal issues.

Understanding Clawback Provisions and Their Relation to FMV (clawback provision example)

A clawback provision example might be in executive compensation. It allows a company to reclaim money paid to an executive. This often happens if financial results are later restated due to misconduct.

FMV can play a role here. If a bonus was based on an inflated valuation, the clawback might require repayment. This ensures that compensation aligns with true, fair market performance.

Common Challenges and Best Practices in FMV Assessment

Overcoming Data Limitations and Subjectivity

Finding enough comparable sales data can be hard. Unique assets often lack direct comparisons. Valuation also involves some judgment, which can be subjective.

To overcome this, use multiple data sources. Always document your assumptions clearly. Be ready to explain your reasoning.

The Role of Professional Appraisals and Expert Opinions

For complex assets, a professional appraisal is often best. Certified appraisers have specific training. They follow strict standards to provide unbiased valuations.

Their expert opinion adds credibility. It can prevent disputes in legal or tax matters. Always seek qualified help when needed.

It's worth noting that for certain transactions, such as large charitable donations of non-cash assets or complex estate valuations, the IRS often requires a qualified appraisal by a professional. This ensures the valuation meets specific regulatory standards and reduces the likelihood of audits or disputes. A professional appraisal provides an unbiased, defensible estimate of fair market price, crucial for legal and tax compliance.

When to Get a Professional Appraisal:

- Selling or buying a business.

- Dealing with estate or gift taxes.

- Disputes over asset value.

- Complex or unique property types.

Ensuring Compliance and Avoiding Disputes

Always follow relevant laws and regulations. Tax authorities like the IRS have specific guidelines for FMV. Ignoring these can lead to penalties.

Clear documentation of your valuation process is vital. This helps defend your FMV assessment. It also reduces the chance of disagreements.

Beyond FMV: Related Concepts and Future Outlook

The Evolution of Valuation Standards

Valuation standards are always changing. New economic realities and technologies shape them. Professional bodies like the Appraisal Institute update their guidelines regularly.

Staying informed about these changes is important. It ensures your valuations remain current. This helps maintain accuracy and compliance.

Impact of Technology on FMV Determination

Technology is changing how we determine FMV. Big data analytics can process vast amounts of market information. AI and machine learning tools can identify trends and patterns quickly.

These tools make valuations faster and potentially more precise. They reduce human error. However, human expertise remains crucial for interpreting data.

Advanced analytics platforms can now sift through massive datasets, from property sales records to stock market trends and even compensation benchmarks, to provide more granular insights. Machine learning algorithms can identify subtle patterns and correlations that might be missed by manual analysis, making the process of understanding how to determine FMV more efficient. These technologies, similar to those powering advanced recruitment platforms like CVShelf for talent matching, are revolutionizing how we approach complex valuations.

Continuous Learning for Accurate Valuations

The world of valuation is dynamic. New methods and data sources emerge constantly. Continuous learning is essential for anyone involved in FMV assessment.

Attend workshops, read industry publications, and consult experts. This commitment ensures you can always accurately assess asset values. It builds confidence in your financial decisions.

Key Takeaways for FMV:

| Concept | Importance |

|---|---|

| Definition | Foundation for all valuations. |

| Methods | Sales comparison, income, cost approaches. |

| Factors | Market, asset specifics, motivations. |

| Challenges | Data limits, subjectivity, compliance. |

| Best Practices | Professional help, clear documentation. |

Mastering Fair Market Value is a valuable skill. It empowers you to make informed financial decisions. By using the right methods and understanding key factors, you can determine FMV accurately. This ensures fairness and compliance in all your transactions.

Frequently Asked Questions About Fair Market Value

What is the core definition of Fair Market Value?

The definition of fair market value is a price.

It is for an item in a free market.

Both the buyer and seller agree on this price.

No one feels forced to buy or sell.

How does Fair Market Value differ from other pricing concepts?

FMV means a deal between two free parties.

A unique selling price definition shows a product's special traits.

The term fair market price is like FMV, but FMV is more strict.

FMV looks at a wider, open market, not just a quick sale.

When is it most important to know how to determine FMV?

It helps in big money choices.

Knowing how to determine fmv is key for selling homes or firms.

It also helps with taxes and plans for your estate.

Good FMV makes deals fair and keeps you out of trouble.

Can you give a real-world clawback provision example related to FMV?

A clawback provision example is when a firm takes back pay.

This happens if a bonus was based on wrong numbers.

If a value was too high, the firm can ask for money back.

This makes sure pay matches true, fair value.

What are common mistakes people make when assessing FMV?

One common error is using too little past sales data.

People may not look at how the market is doing now.

They might also skip getting a pro's view for complex items.

These errors can lead to wrong values and issues later.

How can technology improve FMV determination?

Tech like AI can look at lots of market data fast.

These tools find trends that people might miss.

They also help make values more fair and less biased.

Why is continuous learning important for accurate valuations?

Rules for value and market trends always change.

New data and ways to value things come out often.

Staying up-to-date keeps your value checks correct and strong.

This helps you make smart money choices with trust.

How useful was this post?

Click on a star to rate it!

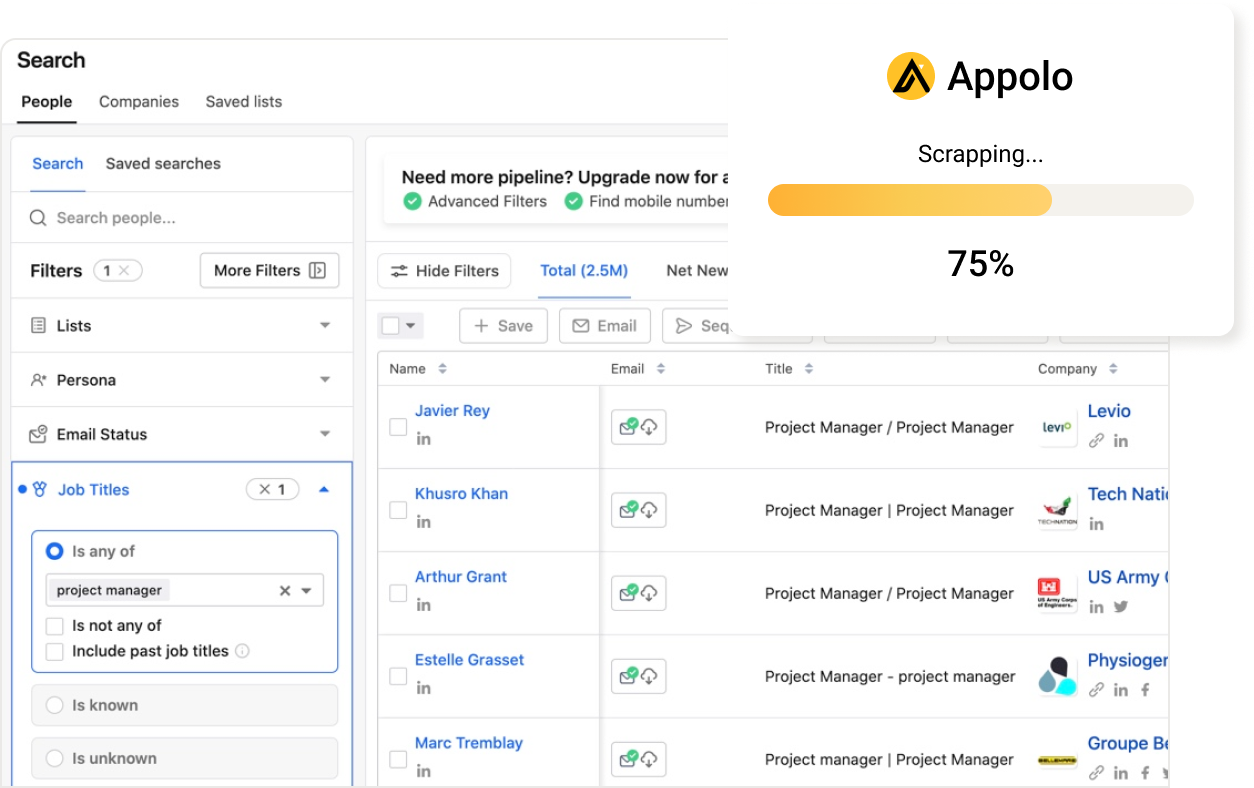

Export Leads from

Sales Navigator, Apollo, Linkedin