Content

Net Asset Value: Mastering the Formula for Net Asset Calculation

Understanding a company's true worth can often seem complex.

Financial terms sometimes feel like a foreign language to many people. One crucial concept helps clarify this financial mystery: Net Asset Value, or NAV.

This comprehensive guide will simplify NAV for everyone, from new investors to seasoned business owners.

Globally, the mutual fund industry alone manages trillions of dollars in assets, with NAV being the cornerstone of their daily operations and investor transactions. For instance, as of Q4 2023, the total net assets of U.S. mutual funds stood at over $27 trillion. Every single dollar of this vast sum is valued and traded based on its Net Asset Value. Understanding the fundamental formula for net asset calculation isn't just academic; it's essential for anyone navigating the financial markets.

We will thoroughly explore the core formula for net asset calculation and its various components. You will learn precisely how to use this vital financial knowledge effectively in different scenarios.

What is Net Asset Value (NAV)? A Foundational Understanding

Defining Net Asset Value in Simple Terms

Net Asset Value (NAV) fundamentally represents the total value of an entity's assets minus its total liabilities.

You can think of it as the amount of money you would have left if you sold everything an entity owns and then paid off all its outstanding debts.

This single figure provides a clear and immediate snapshot of an entity's financial health at a very specific point in time.

Expert Tip: To quickly grasp NAV, imagine a simple lemonade stand. If you sell all your lemons, sugar, and cups (assets) and then pay off what you owe for ingredients (liabilities), the cash left over is your Net Asset Value. This simple mental exercise helps demystify the core formula for net asset for any entity, large or small.

This calculation is especially important for investment funds, such as mutual funds and ETFs, and for assessing the underlying value of businesses.

The Significance of NAV for Investors and Businesses

For individual investors, NAV is critical because it helps determine the per-share value of mutual funds or Exchange Traded Funds (ETFs).

Businesses regularly use NAV to assess their overall financial standing, understand their equity position, and measure their intrinsic worth.

It provides a crucial baseline for accurate valuation, strategic financial planning, and making informed capital allocation decisions.

A deep understanding of NAV is undeniably key to making sound and well-informed financial decisions in various contexts.

Historical Context and Evolution of NAV Calculation

The underlying concept of net assets has existed in various forms for centuries, dating back to early accounting practices.

Its formal and standardized application in modern investment funds became particularly prominent during the early 20th century, especially with the rise of mutual funds.

Financial regulations have continuously evolved over time to ensure consistent, transparent, and fair NAV reporting across different industries.

Today, advanced technology and sophisticated software make calculating and disseminating accurate NAV figures faster and more accessible than ever before.

Deconstructing the Formula for Net Asset: Components and Calculation

The Basic Formula for Net Asset: Assets Minus Liabilities

The fundamental formula for net asset is remarkably straightforward: Total Assets - Total Liabilities = Net Asset Value.

Assets encompass everything an entity owns that possesses economic value, providing future benefits.

Liabilities, conversely, represent everything an entity legally owes to other parties or creditors.

This simple yet powerful equation forms the absolute bedrock of fundamental financial analysis and valuation.

Real-World Example: Consider a small tech startup. They might have $50,000 in cash, $20,000 in office equipment, and $30,000 in accounts receivable (money owed to them). Their total assets would be $100,000. If they have $15,000 in short-term loans and $5,000 in unpaid bills, their total liabilities are $20,000. Using the formula for net asset: $100,000 (Assets) - $20,000 (Liabilities) = $80,000 Net Asset Value. This $80,000 represents the company's book value.

Identifying Current and Non-Current Assets in the Formula

Assets are typically categorized into two main types based on their liquidity: current assets and non-current assets.

Current assets include highly liquid items like cash, accounts receivable (money owed to the entity), and inventory, which are convertible to cash within one year.

Non-current assets are long-term holdings such as property, plant, and equipment (PP&E), long-term investments, and intangible assets like patents.

Accurately identifying and valuing both types of assets is absolutely crucial when applying the formula for net asset.

| Asset Type | Examples | Description |

|---|---|---|

| Current Assets | Cash, Accounts Receivable, Inventory, Short-term Investments, Prepaid Expenses | Assets expected to be converted to cash or used up within one operating cycle or one year. |

| Non-Current Assets | Property, Plant, Equipment (PP&E), Long-term Investments, Intangible Assets (Patents, Trademarks, Goodwill) | Assets held for long-term use, not expected to be converted to cash within a year. |

Understanding Liabilities: Short-Term vs. Long-Term Debts

Similar to assets, liabilities are also classified based on their maturity or when they are due.

Short-term liabilities, also known as current liabilities, are debts or obligations due within one year, such as accounts payable or short-term loans.

Long-term liabilities are financial obligations due beyond one year, which can include mortgages payable, bonds payable, or long-term lease obligations.

Accurately identifying, quantifying, and including all types of liabilities is absolutely vital for a precise calculation using the formula for net asset.

Practical Applications of the Formula for Net Asset

NAV in Mutual Funds and ETFs: What it Means for Investors

For investment vehicles like mutual funds and Exchange Traded Funds (ETFs), NAV precisely represents the per-share value of the fund's underlying assets.

This value is calculated by taking the fund's total assets (which include all its investments and cash) minus its total liabilities (such as operating expenses) and then dividing by the total number of outstanding shares.

Investors typically buy or sell shares of these funds at their calculated NAV, or at a price very close to it, especially at the end of the trading day.

Understanding this daily NAV helps investors accurately evaluate fund performance, assess its pricing, and make informed investment decisions.

Applying the Formula for Net Asset in Business Valuation

Businesses frequently use the formula for net asset to determine their fundamental book value or shareholder equity.

This calculation provides a crucial baseline for valuing a company, particularly when considering scenarios like liquidation or asset-based transactions.

It helps various stakeholders, including potential buyers and creditors, understand the company's intrinsic worth based directly on its balance sheet.

While it is not the sole valuation method, the net asset formula offers a foundational and tangible perspective on a company's financial standing.

How Net Assets Equity Relates to Overall Financial Health

The term net assets equity is often used interchangeably with owner's equity or shareholder's equity in a business context.

A consistently positive and steadily growing net assets equity generally indicates robust financial stability, strong profitability, and sustainable growth for a company.

It explicitly shows the portion of a company's assets that has been financed by its owners or through retained earnings, rather than by external creditors.

Regularly monitoring this crucial figure helps assess a company's long-term viability, its ability to withstand financial shocks, and its capacity for future expansion.

What a Growing Net Assets Equity Signifies:

- Enhanced Financial Stability: A larger net assets equity base means the company has more internal resources to weather economic downturns or unexpected expenses without relying heavily on external debt.

- Increased Borrowing Capacity: Lenders often view higher equity as a sign of financial strength, potentially leading to better loan terms and greater access to capital for growth.

- Stronger Shareholder Confidence: For public companies, consistent growth in net assets equity can attract investors, signaling effective management and a solid foundation for future returns.

- Flexibility for Reinvestment: More equity allows a business to reinvest profits back into operations, research and development, or acquisitions, fueling organic expansion.

Conversely, a declining net assets equity can be a red flag, indicating potential losses, excessive debt, or inefficient asset management.

| Context | How NAV is Primarily Used | Significance for Key Stakeholders |

|---|---|---|

| Mutual Funds/ETFs | Determines the daily per-share price for investor transactions. | Investors: Ensures fair valuation for buying, selling, and performance tracking. |

| Operating Businesses | Calculates book value, assesses solvency, and indicates owner's equity. | Owners/Creditors: Reveals financial health, collateral, and capital structure. |

| Non-profit Organizations | Measures financial resources available to achieve their mission. | Donors/Public: Demonstrates accountability, resource allocation efficiency, and sustainability. |

| Real Estate Holdings | Used to value properties within a portfolio, net of mortgages. | Investors/Developers: Assesses portfolio health and potential for returns. |

Beyond the Basics: Advanced Considerations for Net Asset Calculation

Impact of Intangible Assets and Depreciation on the Formula for Net Asset

Intangible assets, such as patents, copyrights, brand reputation, or customer lists, can significantly impact a company's true market value, even if harder to quantify.

While some intangibles are formally recognized on the balance sheet and included in asset calculations, others, like brand equity, might not be.

Depreciation, which is the systematic reduction in the recorded cost of a tangible asset over its useful life, directly reduces the total asset value over time.

Properly accounting for both recognized intangible assets and the ongoing impact of depreciation refines the accuracy of the formula for net asset.

Consider the difference between a manufacturing company and a software company. The manufacturer's NAV might heavily rely on tangible assets like machinery and buildings, which depreciate over time. For a software company, however, its most valuable assets might be its proprietary code, patents, or brand—intangibles that are harder to value and don't depreciate in the same way. While some, like patents, are on the balance sheet, others, like brand reputation, are not. This distinction highlights why the formula for net asset, while foundational, doesn't always capture a company's full market value, especially for businesses rich in unrecorded intangible assets.

Adjustments and Special Cases in NAV Determination

Certain specific situations and industries often require unique adjustments to the standard NAV formula for a more accurate representation.

For example, in real estate investment trusts (REITs), analysts might use Adjusted Funds From Operations (AFFO) or Net Asset Value (NAV) based on appraisals, rather than just book value.

Liquidation value, which is the estimated value of assets if a company were to be dissolved, might differ significantly from its ongoing book value, especially for distressed assets.

Understanding these industry-specific nuances and special accounting cases is absolutely crucial for precise and meaningful valuation.

Common Pitfalls When Calculating the Formula for Net Asset

One very common error encountered is the incorrect classification of assets or liabilities on the balance sheet, leading to skewed results.

Overlooking off-balance-sheet items, such as certain operating leases or contingent liabilities, can lead to a significantly inaccurate NAV.

Not adequately accounting for rapid market fluctuations, especially for investment funds holding volatile securities, is another frequent pitfall when using the formula for net asset.

Always ensure that all relevant financial data is completely current, accurately valued, and correctly categorized to avoid these errors.

Maximizing Value: Interpreting and Utilizing Net Asset Information

Benchmarking Performance with NAV: Is Your ROI Mean on Track?

Tracking the changes in Net Asset Value over successive periods provides an excellent way to assess an entity's financial performance.

For investment funds, a consistently rising NAV per share often indicates strong investment management, positive returns, and effective portfolio growth.

It is highly beneficial to compare your fund's or company's NAV growth against relevant industry benchmarks or a predefined target roi mean.

This comparative analysis helps you effectively evaluate if your investment strategy or business operations are truly on track to meet financial objectives.

Actionable Tip: Setting Your ROI Mean Target with NAV: When evaluating an investment fund, don't just look at past performance. Project your desired roi mean and then determine what consistent NAV growth is needed to achieve it. For example, if you aim for a 7% annual return, you'll need the NAV per share to increase by roughly 7% each year, assuming no distributions. Regularly compare the actual NAV trend against this target to make timely adjustments to your portfolio or business strategy. This proactive approach helps ensure your financial goals remain within reach.

Strategic Decision-Making Based on Net Asset Trends

Businesses actively use observed trends in their Net Asset Value to inform critical strategic decisions and guide future actions.

A persistently declining NAV might signal underlying financial distress, inefficient asset utilization, or perhaps unsustainable debt levels within the organization.

Conversely, consistent and healthy growth in NAV suggests strong financial management, robust profitability, and significant potential for future expansion or shareholder returns.

These vital trends can directly guide decisions regarding new investments, debt restructuring, capital expenditures, and equity financing.

The Future of Net Asset Reporting and Transparency

Technological advancements continue to significantly enhance the speed, accuracy, and accessibility of Net Asset Value reporting across all sectors.

Increased regulatory scrutiny and demands from investors are pushing for even greater transparency in financial disclosures and NAV calculations.

Emerging technologies like blockchain could potentially play a transformative role in creating more immutable, verifiable, and real-time NAV calculations.

These ongoing advancements promise to provide clearer, more reliable, and more immediate financial insights for investors, businesses, and the public alike.

The advent of AI and automation is further revolutionizing NAV calculation. Automated systems can process vast amounts of financial data, reconcile accounts, and apply complex valuation models with unprecedented speed and accuracy. This not only reduces human error but also allows for more frequent, even real-time, NAV updates, providing investors and businesses with the most current financial picture. Such technological integration ensures that the application of the formula for net asset remains precise and timely in an increasingly dynamic financial landscape.

| Tip | Description |

|---|---|

| Monitor Trends Diligently | Do not just look at a single NAV figure; consistently observe its movement and patterns over extended periods to identify growth or decline. |

| Compare to Peers and Benchmarks | Benchmark your fund's or company's NAV performance against similar entities in the same industry or against relevant market indices. |

| Understand Underlying Components | Always dig deeper into the specific assets and liabilities that compose the NAV to understand what truly drives its value. |

| Consider Contextual Factors | Remember that NAV is just one financial metric; combine it with other key financial ratios and qualitative factors for a complete view. |

| Seek Professional Guidance | For complex financial situations or significant investment decisions, always consult with qualified financial advisors or accountants. |

Conclusion

Net Asset Value stands as a truly fundamental and indispensable concept in the world of finance.

It provides a remarkably clear and concise picture of what an entity genuinely owns after meticulously accounting for all its outstanding debts.

By thoroughly understanding the simple yet profoundly powerful formula for net asset, you gain an incredibly valuable analytical tool.

This essential knowledge empowers you to make significantly smarter and more confident investment choices. It also helps you evaluate the overall financial health and intrinsic worth of businesses much more effectively. Continue learning and diligently applying these core financial principles for achieving greater financial clarity and success.

What is the core difference between Net Asset Value and market capitalization for a company?

NAV shows a company's book value.

It subtracts total liabilities from total assets. Learn more about the formula here.

Market capitalization shows the total value of a company's shares.

This figure reflects what the market thinks the company is worth today.

How often is Net Asset Value calculated, and why is this frequency important?

Mutual funds usually calculate their NAV daily.

They do this after the market closes each business day. Investopedia explains daily NAV.

This daily update ensures fair pricing for investors buying or selling shares.

Other businesses may assess NAV less often, perhaps quarterly or yearly.

Can Net Asset Value be negative, and what does that mean for an entity?

Yes, Net Asset Value can be negative.

A negative NAV means an entity's total debts are more than its total assets.

This situation often points to serious financial trouble.

It means the entity owes more than it owns.

How does the formula for net asset apply to non-profit organizations?

Non-profit groups also use the formula for net asset.

For them, net assets show resources available for their mission.

They track assets "with donor restrictions" and "without restrictions." The Council of Nonprofits provides more details.

This helps donors see how the organization manages its funds.

What role does net assets equity play in a company's balance sheet, and how does it relate to shareholder value?

Net assets equity is a key part of a company's balance sheet.

It represents the owners' stake in the company.

This figure shows assets funded by owners or retained profits.

Growing net assets equity often means more shareholder value and financial strength.

How can understanding NAV help me assess the potential roi mean of an investment fund?

Understanding a fund's NAV helps you track its performance.

A rising NAV per share means the fund's investments are growing.

You can compare NAV changes to your initial investment for returns.

This helps you see if the fund can reach your target roi mean.

How useful was this post?

Click on a star to rate it!

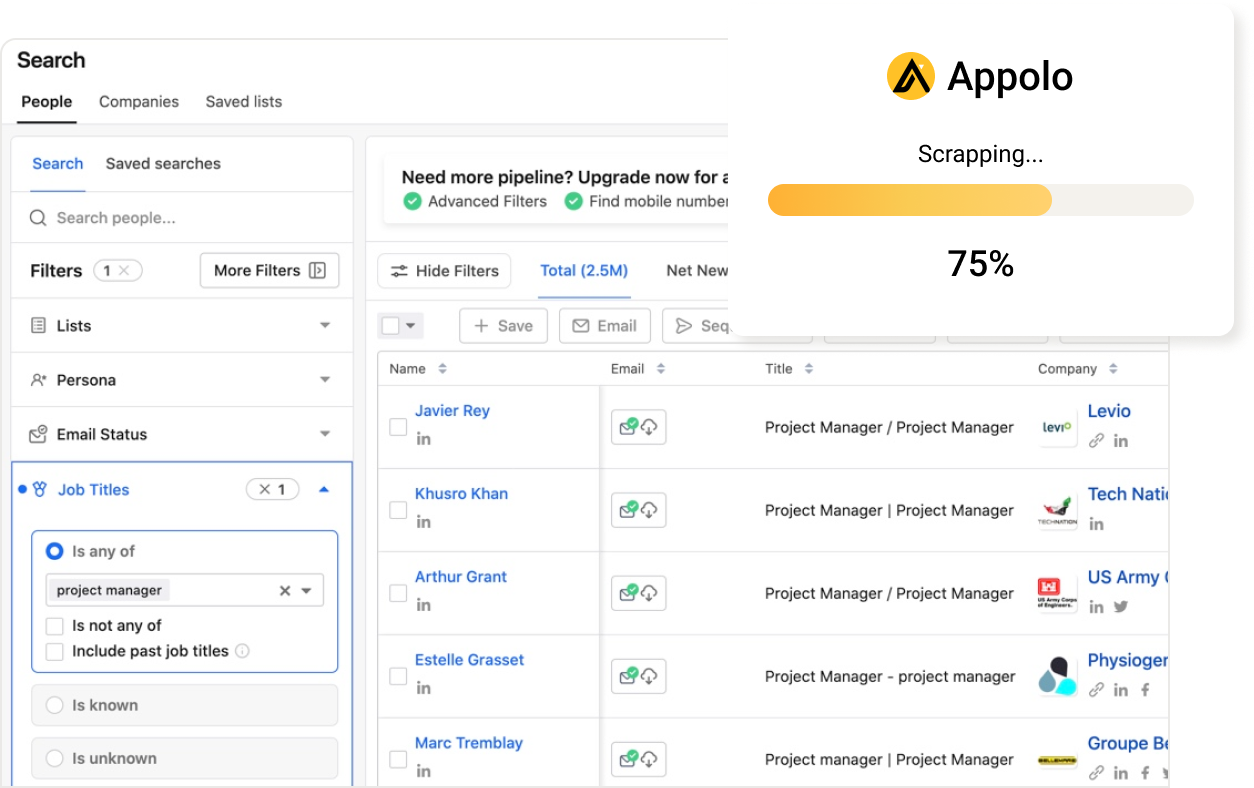

Export Leads from

Sales Navigator, Apollo, Linkedin