Content

FMV Meaning: Understanding Fair Market Value for Smart Decisions

FMV Meaning: Understanding Fair Market Value for Smart Business Decisions

Every business transaction, from selling a company to valuing an asset, relies on a crucial concept.

This concept is Fair Market Value, often shortened to FMV.

It represents the price an asset would fetch in an open and competitive market.

Understanding the true fmv meaning is essential for making smart financial choices.

Accurate FMV helps businesses navigate complex deals and meet compliance needs.

Let's explore what FMV truly represents and why it matters so much in today's economy.

Understanding FMV Meaning: The Core Definition

To truly grasp its importance, we must first define Fair Market Value clearly.

It's more than just a price; it's a specific kind of price determined under specific conditions.

This section dives into the fundamental aspects of what FMV means.

We will also distinguish it from other common valuation terms.

What Exactly is Fair Market Value?

Fair Market Value (FMV) describes the price an asset would sell for in an open and competitive market.

It assumes both buyer and seller are willing, well-informed, and acting in their own best interest.

Neither party is under any undue pressure to buy or sell.

This definition is central to grasping the full fmv meaning.

Think of it as the sweet spot where a deal can happen fairly.

Differentiating FMV from Other Valuation Terms

FMV is often confused with terms like book value or intrinsic value.

Book value is an asset's historical cost minus depreciation on a company's balance sheet.

Intrinsic value represents an asset's true worth based on its future cash flows, regardless of market price.

Unlike these, FMV focuses on what a market participant would pay today in a real transaction.

Market value, while similar, can sometimes refer to a specific trading price, which might not always meet all FMV conditions.

The Legal and Economic Context of FMV

FMV plays a significant role in legal and economic frameworks worldwide.

Courts often use it in divorce settlements, eminent domain cases, and estate planning.

For example, the IRS mandates the use of FMV for valuing assets in gift and estate tax returns. You can find more details in IRS Publication 561.

Economically, FMV helps ensure fair trade and transparent pricing across various sectors.

It provides a consistent benchmark for various financial transactions and reporting.

Why Fair Market Value Matters: Importance Across Industries

Accurate FMV assessments are not just theoretical; they are vital across many sectors.

They influence decisions ranging from major corporate deals to individual tax filings and estate planning.

Ignoring FMV can lead to significant financial and legal problems for businesses and individuals.

Let's look at its broad and critical impact across diverse industries and financial situations.

Role of FMV in Mergers and Acquisitions

In M&A, FMV determines the purchase price of a target company.

Buyers use it to avoid overpaying, while sellers aim to maximize their returns.

An independent FMV assessment provides a neutral basis for complex negotiations.

This ensures a fair deal for both parties involved, reducing disputes.

It also helps in allocating the purchase price among various assets acquired.

Tax Implications and Compliance with FMV

Tax authorities frequently rely on FMV for various purposes.

This includes calculating capital gains, gift taxes, and estate taxes.

The IRS, for instance, requires assets to be valued at their FMV for tax compliance.

Proper FMV reporting helps avoid audits and significant penalties.

Businesses must adhere to these guidelines to maintain legal standing.

FMV in Financial Reporting and Asset Valuation

Companies use FMV to report asset values on their balance sheets.

This is especially true for assets like real estate, equipment, and certain investments.

Accurate FMV ensures financial statements reflect true economic conditions.

It also supports sound investment decisions by providing realistic asset values.

Publicly traded companies often use FMV for quarterly and annual reports.

Key Methodologies for Determining FMV

Valuing assets to find their FMV requires specific, recognized approaches.

Experts use several widely accepted methodologies to arrive at a fair estimate.

The choice of method depends heavily on the asset type, industry, and available data.

Here are the primary ways valuation professionals calculate FMV, each with its own strengths.

Income Approach: Discounted Cash Flow (DCF) and Capitalization of Earnings

The income approach values an asset based on the income it is expected to generate in the future.

Discounted Cash Flow (DCF) projects future cash flows and discounts them back to a present value using a discount rate.

This method is common for valuing businesses or income-generating properties like rental buildings.

It requires careful forecasting of revenues and expenses.

Capitalization of Earnings converts a single period's earnings into a value by dividing it by a capitalization rate.

Market Approach: Comparable Company Analysis and Precedent Transactions

The market approach compares the asset being valued to similar assets recently sold in the market.

Comparable Company Analysis looks at publicly traded companies similar to the one being valued in terms of industry, size, and growth.

Analysts use valuation multiples like Price-to-Earnings (P/E) or Enterprise Value-to-EBITDA to derive value.

Precedent Transactions examines prices paid in actual M&A deals involving similar companies or assets.

This method relies heavily on the availability of relevant and recent transaction data.

Asset Approach: Adjusted Book Value and Replacement Cost

The asset approach values an asset based on the cost to replace or reproduce it.

Adjusted Book Value modifies a company's balance sheet to reflect current market values of its individual assets and liabilities.

This method is often used for asset-heavy businesses, holding companies, or those facing liquidation.

Replacement Cost estimates the expense to build or acquire a new asset with similar utility and function.

It considers current material and labor costs, not historical purchase prices.

| Method | Description | Best For |

|---|---|---|

| Income Approach | Values based on future earnings/cash flows | Businesses, income-generating properties |

| Market Approach | Compares to similar recent sales | Publicly traded companies, real estate |

| Asset Approach | Values based on cost to replace/reproduce | Asset-heavy businesses, unique assets |

Practical Applications of FMV in Business and Finance

FMV is not just a theoretical concept; it has many real-world, tangible uses.

Businesses and individuals apply FMV in various strategic and operational decisions daily.

From selling a company to assessing property or intellectual property, its relevance is clear.

Let's explore some key practical applications where FMV plays a decisive role.

Business Valuations for Sales and Investments

When selling a business, a precise FMV helps set a realistic and attractive asking price.

Investors use FMV to determine if a potential acquisition or investment is fairly priced.

This knowledge empowers both buyers and sellers in complex negotiations.

It ensures a transparent and equitable transaction, fostering trust.

For startups seeking funding, a strong FMV valuation can attract investors.

Real Estate and Property Assessments Using FMV

Real estate agents and professional appraisers constantly use FMV.

They determine property values for sales, mortgages, and property taxes.

Factors like location, condition, recent comparable sales, and local market trends influence real estate FMV.

Understanding fmv meaning finance is crucial in this sector, impacting homeowners and investors alike.

Online tools can give estimates, but a professional appraisal offers the most accurate FMV.

Valuing Intangible Assets and Intellectual Property

Intangible assets like patents, trademarks, brand names, and customer lists also have FMV.

Valuing these can be complex due to their non-physical nature and unique characteristics.

However, their FMV is critical for M&A, licensing agreements, financial reporting, and litigation.

Specialized methods, often combining income and market approaches, are used for these unique assets.

A strong brand, for example, can significantly boost a company's overall FMV.

Tip Box 1: Key Considerations for FMV

- Always consider the purpose: Why do you need the FMV? (e.g., tax, sale, reporting)

- Gather comprehensive data: More data leads to more accurate valuations.

- Seek expert advice: Professional appraisers offer unbiased, informed assessments.

- Review regularly: FMV can change over time due to market shifts.

Challenges and Best Practices in FMV Assessment

Determining FMV is not always straightforward and can present various complexities.

Several challenges and common pitfalls can arise during the valuation process.

Adopting best practices helps overcome these hurdles and ensures reliable results.

Ensuring accuracy, objectivity, and data integrity is paramount for any FMV assessment.

Common Pitfalls and Misconceptions in Determining FMV

A common mistake is confusing FMV with liquidation value, which is often much lower.

Another pitfall is relying solely on historical costs without considering current market dynamics.

Lack of comparable data for unique or niche assets can also pose a significant challenge.

Overlooking specific market conditions or broader economic trends leads to inaccurate valuations.

A clear understanding of fmv meaning helps avoid these common pitfalls.

The Role of Expert Appraisers and Independent Valuations

Professional appraisers bring specialized knowledge and extensive experience to the valuation process.

They use established methodologies and adhere to strict valuation standards set by industry bodies like the American Society of Appraisers.

An independent valuation provides an unbiased and credible opinion of FMV.

This independence is crucial for credibility, especially in legal, tax, or investment contexts.

For complex valuations, engaging a certified appraiser is highly recommended.

Maintaining Objectivity and Data Integrity

Objectivity is paramount for a reliable FMV assessment.

Valuers must actively avoid personal biases or conflicts of interest that could sway the outcome.

Ensuring the accuracy, completeness, and relevance of all underlying data is equally important.

Rigorous data verification processes and transparent assumptions strengthen the valuation's credibility.

Any assumptions made should be clearly documented and justifiable.

| Factor | Impact on FMV | Example |

|---|---|---|

| Market Conditions | Supply, demand, economic outlook | High demand for tech companies increases their FMV. |

| Asset Condition | Age, wear and tear, maintenance | A well-maintained property has higher FMV. |

| Comparables | Recent sales of similar assets | Similar houses in the neighborhood sold for X price. |

| Future Earnings | Expected cash flows, growth potential | A business with strong growth prospects has higher FMV. |

| Intangibles | Brand reputation, patents, customer base | A strong brand like Apple adds significant FMV. |

Tip Box 2: Steps to Estimate FMV

- Define the Asset: Clearly identify what is being valued (e.g., a business, a property, a patent).

- Determine the Purpose: Understand why the valuation is needed (e.g., sale, tax, litigation).

- Gather Data: Collect all relevant financial, operational, and market data.

- Choose Methodology: Select the most appropriate valuation approach (income, market, or asset). More on valuation methods can be found on Investopedia.

- Perform Analysis: Apply the chosen method, making reasonable assumptions.

- Review and Adjust: Critically review the preliminary valuation and make adjustments as needed.

- Document Findings: Prepare a detailed report outlining the methodology, data, and conclusions.

Leveraging FMV for Strategic Business Growth

Understanding FMV is far more than just a compliance exercise or a number for tax forms.

It is a powerful strategic tool for driving business planning and future growth.

Accurate FMV insights can significantly enhance decision-making, improve negotiation power, and boost profitability.

Businesses can use it to gain a substantial competitive edge in the market.

Informed Decision-Making with Accurate FMV

Knowing the true FMV of assets and businesses enables better strategic decisions.

This includes choices about investments, divestitures, capital allocation, and business expansion.

It helps companies prioritize resources effectively and identify undervalued opportunities.

Strategic planning becomes more robust and data-driven with precise FMV data.

Businesses can confidently pursue growth initiatives when they understand their true worth.

Negotiation Power and Transaction Optimization

When entering negotiations, strong FMV data provides a significant advantage.

Sellers can justify their asking price with confidence, backed by solid valuation principles.

Buyers can negotiate better deals, avoiding overpayment and ensuring a fair return on investment.

Optimizing transactions based on accurate FMV leads to better financial outcomes for all parties.

This power extends to mergers, acquisitions, and even internal transfers.

Future Trends and the Evolving Landscape of FMV

The world of valuation is constantly changing, driven by technological advancements and market shifts.

New technologies, like artificial intelligence and big data analytics, are impacting FMV assessments.

Increased global interconnectedness and rapid economic changes also affect market dynamics.

Staying informed about these evolving trends is crucial for accurate future valuations.

Digital assets and cryptocurrency valuations represent new frontiers for FMV experts.

| Scenario | Why FMV is Important |

|---|---|

| Buying a business | Ensures you pay a fair price, not overpaying. |

| Selling a business | Helps set an attractive yet profitable asking price. |

| Estate planning | Determines asset values for inheritance and taxes. |

| Loan collateral | Lenders assess asset value to secure loans. |

| Insurance claims | Helps determine replacement value for damaged assets. |

Understanding the fmv meaning is fundamental for anyone navigating the complexities of business or finance.

It underpins fair transactions, ensures crucial tax compliance, and guides strategic decisions for future success.

While the process can be complex, applying the right methodologies and seeking expert advice can simplify it immensely.

By mastering Fair Market Value, you empower yourself and your organization to make truly smart, informed business decisions.

Embrace FMV as a cornerstone of financial literacy and strategic advantage.

Frequently Asked Questions About FMV

What is the main difference between FMV and market price?

Fair Market Value (FMV) is a theoretical price. It assumes perfect conditions for a sale. Both buyer and seller know all facts. They are also free from pressure. Market price is the actual price. An asset sells for this price right now. This price may not meet all FMV rules. For example, a quick sale might lower the market price. This could be below its true FMV.

Why is an independent appraisal important for FMV?

An independent appraisal gives an unbiased view. It ensures the valuation is fair. Professional appraisers follow strict rules. They use proven methods to calculate FMV. This helps avoid conflicts of interest. It also adds trust to the valuation. This is key for legal or tax matters.

How does FMV impact personal financial planning?

FMV is very important for personal finance. It affects things like estate and gift taxes. When you give a gift, its value for tax is its fmv meaning. The IRS uses FMV to tax inherited assets too. Knowing the FMV helps you plan your estate wisely. It can also help reduce future tax burdens. This ensures your assets are handled correctly.

Can FMV change over time, and what causes these changes?

Yes, FMV can change often. Market conditions are a big reason. For example, high demand for a product can raise its FMV. New technology or economic shifts also play a role. The condition of the asset itself matters too. A well-kept property holds its FMV better. Understanding fmv meaning finance helps you track these shifts. It allows you to make smart decisions over time.

What kinds of assets can you value using FMV?

You can value many types of assets with FMV. This includes both physical and non-physical items. FMV helps decide their worth in a fair sale. It applies to almost anything with market potential. Here are some examples:

- Real estate (houses, land, commercial buildings)

- Vehicles (cars, trucks, boats)

- Businesses (small companies to large corporations)

- Intangible assets (patents, trademarks, brand names)

- Equipment and machinery

- Artwork and collectibles

Each asset type needs a specific valuation method. But the goal is always to find its Fair Market Value.

How can a business use FMV to improve its operations?

Businesses use FMV for many smart moves. It helps them set fair prices when selling parts of the company. FMV guides investment choices. It shows if a potential buy is a good deal. Accurate FMV helps with financial reporting. This makes financial statements more reliable. It also boosts negotiation power in deals. Knowing your true worth helps you grow stronger.

How useful was this post?

Click on a star to rate it!

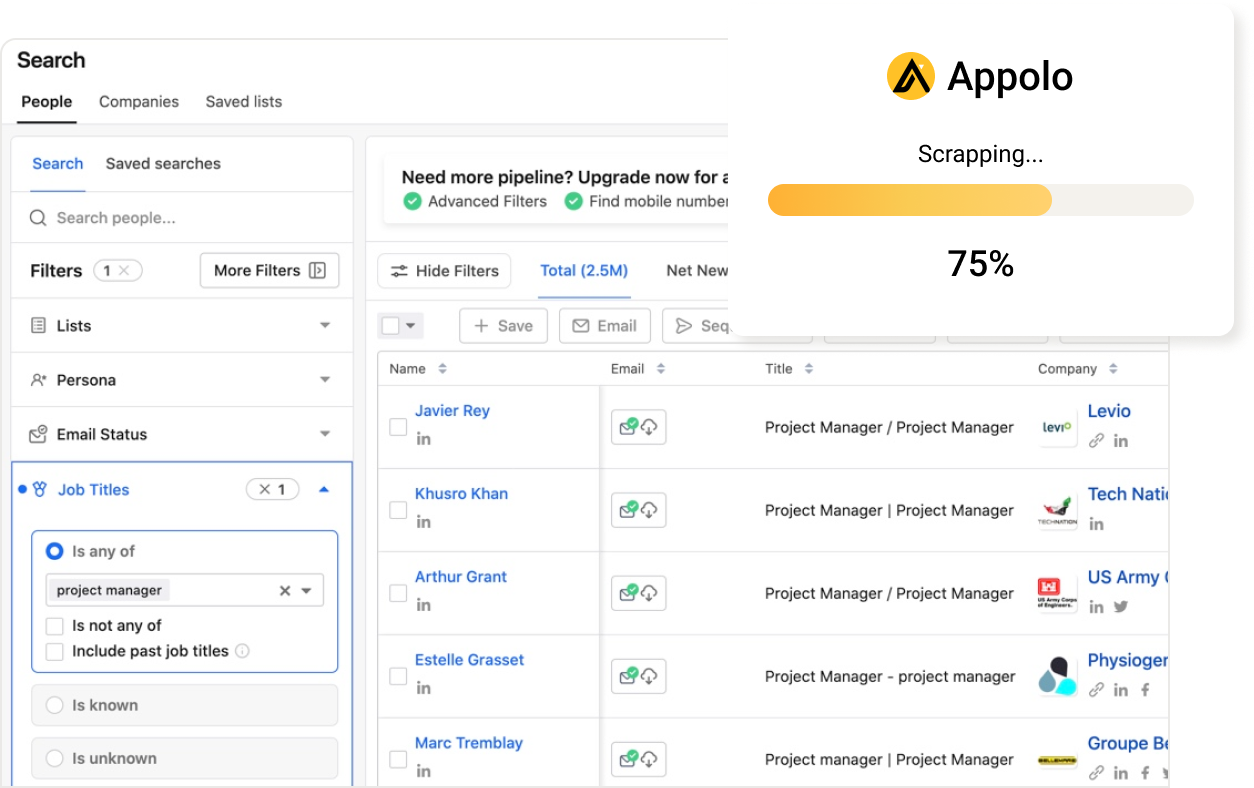

Export Leads from

Sales Navigator, Apollo, Linkedin