Content

Understanding Your Basic Salary: A Complete Guide to Your Pay

Your basic salary is more than just a number on your payslip.

It forms the core of your financial well-being.

This guide will help you fully understand what it means.

Knowing this information empowers you to make smart financial decisions.

Did you know that your basic salary often forms the largest portion of your overall compensation, typically ranging from 40% to 60% of your total pay package in many industries? This core amount isn't just for immediate expenses; it's the foundation for future raises, loan eligibility, and even retirement benefits. Understanding its nuances empowers you to make informed decisions, from budgeting to long-term financial planning, ensuring you maximize your earning potential.

Your basic salary is more than just a number on your payslip; it's the bedrock of your financial stability. It sets the stage for future earnings, benefits, and your overall financial health. Knowing the ins and outs of your basic salary is the first step towards building a secure financial future.

What Constitutes Basic Salary?

Defining the Core Wage Component

This core wage represents the fixed portion of your pay.

It is the amount paid to you before any additions or subtractions.

This component does not include allowances, bonuses, or overtime pay.

It is the fundamental payment for your work.

Legal and Contractual Aspects of Basic Salary

Your employment contract clearly defines this core wage.

It is a legally binding agreement between you and your employer.

Labor laws in your region often set minimum wage standards for this component.

Always review your contract to understand your agreed-upon terms.

When reviewing your employment contract, pay close attention to the clause defining your basic salary. Ensure it aligns with what was discussed during negotiations. Look for details on annual increments, review periods, and any conditions tied to your basic wage. In some regions, labor laws mandate specific minimums or transparency requirements for this component, protecting employees from unfair practices. A clear understanding prevents future discrepancies and ensures your rights are upheld.

When reviewing your employment contract, pay close attention to the clause defining your basic salary. Ensure it aligns with what was discussed during negotiations. Look for details on annual increments, review periods, and any conditions tied to your basic wage. In some regions, labor laws mandate specific minimums or transparency requirements for this component, protecting employees from unfair practices. A clear understanding prevents future discrepancies and ensures your rights are upheld.

Its Role in Overall Compensation Structure

This fixed amount forms the foundation of your entire compensation.

Many other benefits and calculations depend on this figure.

It acts as the base for calculating contributions like Provident Fund.

Understanding this role is crucial for your financial planning.

Key Components Beyond Basic Salary

Allowances and Deductions Explained

Beyond your core wage, you receive various allowances.

These are additional payments for specific purposes, like housing or travel.

Deductions are amounts subtracted from your gross pay.

They can include taxes, loan repayments, or provident fund contributions.

Common Allowances

| Allowance Type | Purpose |

|---|---|

| House Rent Allowance (HRA) | To cover rental expenses for accommodation. |

| Dearness Allowance (DA) | To offset the impact of inflation on living costs. |

| Conveyance Allowance | To cover travel expenses from home to work. |

| Medical Allowance | To help with medical expenses. |

Common Deductions

| Deduction Type | Purpose |

|---|---|

| Provident Fund (PF) | A retirement savings scheme for employees. |

| Income Tax (TDS) | Tax deducted at source by the employer. |

| Professional Tax | A state-level tax on income from professions. |

| Loan Repayments | Deductions for any company loans taken. |

Impact on Provident Fund (PF) and Gratuity Calculations

Your Provident Fund contributions often depend on your basic pay.

Both employer and employee contribute a percentage of this amount.

Gratuity, a lump sum paid upon leaving a job, also links to your last drawn basic pay.

These calculations highlight the long-term importance of your core wage.

For instance, in countries like India, Provident Fund (PF) contributions are typically calculated as 12% of your basic salary plus Dearness Allowance (DA). Both the employer and employee contribute this percentage, building a substantial retirement corpus over time. Similarly, gratuity, a payment made to employees who complete five or more years of service, is often calculated based on your last drawn basic pay. This direct linkage underscores why a strong basic salary is crucial for your long-term financial security.

For instance, in countries like India, Provident Fund (PF) contributions are typically calculated as 12% of your basic salary plus Dearness Allowance (DA). Both the employer and employee contribute this percentage, building a substantial retirement corpus over time. Similarly, gratuity, a payment made to employees who complete five or more years of service, is often calculated based on your last drawn basic pay. This direct linkage underscores why a strong basic salary is crucial for your long-term financial security.

Variable Pay and its Relationship to Fixed Pay

Variable pay includes bonuses, commissions, and performance incentives.

This portion of your compensation changes based on performance or company profits.

Fixed pay, like your basic wage, remains constant.

A balanced compensation package often includes both fixed and variable components.

Why Your Basic Salary is Crucial

The Foundation of Your Financial Package

Indeed, your basic salary acts as the bedrock of your financial life.

It determines your stable income for budgeting and expenses.

This consistent amount provides financial security.

It is the most reliable part of your earnings.

Influence on Future Earnings and Benefits

This core pay directly impacts future raises and benefits.

Increments are often calculated as a percentage of your current basic pay.

Loan eligibility and creditworthiness also consider this stable income.

A higher basic pay can lead to better financial opportunities.

Strategic Financial Planning with Your Basic Salary

Understanding your primary wage is key for smart financial planning.

You can create a realistic budget based on this fixed income.

It helps you determine how much you can save or invest each month.

Plan your long-term financial goals around this stable foundation.

Consider a scenario: If your basic salary is $3,000 per month, you can confidently allocate a fixed percentage, say 15% ($450), towards savings and investments. This consistency allows you to project your financial growth over years, whether it's saving for a down payment on a house, funding a child's education, or building a robust retirement portfolio. Without a stable basic income, such structured planning becomes significantly more challenging, highlighting its role as the anchor of your financial strategy.

Consider a scenario: If your basic salary is $3,000 per month, you can confidently allocate a fixed percentage, say 15% ($450), towards savings and investments. This consistency allows you to project your financial growth over years, whether it's saving for a down payment on a house, funding a child's education, or building a robust retirement portfolio. Without a stable basic income, such structured planning becomes significantly more challenging, highlighting its role as the anchor of your financial strategy.

- Budget Wisely: Allocate funds for necessities and savings first.

- Build an Emergency Fund: Aim for 3-6 months of living expenses based on your basic pay.

- Invest Regularly: Set up automatic transfers to investment accounts.

- Plan for Retirement: Maximize contributions to PF or other retirement schemes.

Basic Salary vs. Gross vs. Net Pay

Understanding the Distinctions

It is vital to distinguish between these three terms.

They represent different stages of your earnings calculation.

Each term has a specific meaning in payroll.

Confusing them can lead to misunderstandings about your income.

Gross Pay: The Sum Before Deductions

Gross pay is your total earnings before any deductions.

It includes your basic wage plus all allowances.

Bonuses and overtime also contribute to gross pay.

This is the total amount your employer pays you before taxes or other subtractions.

Net Pay: What You Actually Take Home

Net pay is the amount you receive after all deductions.

This is often called your 'take-home' pay.

It is calculated by subtracting all taxes, PF, and other deductions from your gross pay.

This is the actual money that lands in your bank account.

| Pay Type | Definition | Includes |

|---|---|---|

| Basic Salary | The fixed, core component of your wage. | Only the base wage. |

| Gross Pay | Total earnings before any deductions. | Basic Salary + Allowances + Variable Pay. |

| Net Pay | What you actually receive after all deductions. | Gross Pay - All Deductions (Taxes, PF, etc.). |

Factors Influencing Your Basic Salary

Market Rates and Industry Standards

Your salary is heavily influenced by what others earn in similar roles.

Industry benchmarks provide a guide for fair compensation.

Researching market rates helps you understand your value.

Websites like Glassdoor or Payscale offer valuable insights.

Experience, Skills, and Education

More experience often leads to a higher starting basic wage.

Specialized skills are highly valued and can command better pay.

Higher education, such as a master's degree, can also boost your earning potential.

Continuous learning and skill development are key to career growth.

Geographical Location and Company Size

Salaries vary significantly by city and country due to cost of living.

Companies in major metropolitan areas often offer higher pay.

Larger companies might have more structured pay scales and better benefits.

Smaller companies might offer competitive pay but different perks.

Strategies for Negotiating Basic Salary

Researching Your Market Value

Before any negotiation, know your worth.

Use salary aggregators and industry reports to find relevant data.

Talk to mentors or colleagues in your field for insights.

This research provides confidence and strong arguments.

Effective Negotiation Techniques

Always state your desired salary range confidently.

Highlight your unique skills and achievements that add value.

Be prepared to justify your request with data and examples.

Practice active listening and be open to compromise.

When negotiating your basic salary, remember to 'anchor high' but be flexible. Start with a figure slightly above your target, allowing room for negotiation. Highlight specific achievements and skills that justify your request, quantifying your value where possible. For example, 'My expertise in [skill] has consistently led to [quantifiable result], which I believe warrants a basic salary in the range of X to Y.' Avoid discussing your previous salary too early, focusing instead on the value you bring to the new role and the market rate for your skills.

When negotiating your basic salary, remember to 'anchor high' but be flexible. Start with a figure slightly above your target, allowing room for negotiation. Highlight specific achievements and skills that justify your request, quantifying your value where possible. For example, 'My expertise in [skill] has consistently led to [quantifiable result], which I believe warrants a basic salary in the range of X to Y.' Avoid discussing your previous salary too early, focusing instead on the value you bring to the new role and the market rate for your skills.

Considering the Full Compensation Offer Beyond Basic Salary

Look at the entire package, not just the base wage.

Benefits like health insurance, retirement plans, and paid time off are valuable.

Consider growth opportunities, company culture, and work-life balance.

A lower basic wage might be acceptable if other benefits are strong.

Conclusion

Understanding your basic salary empowers you to manage your finances effectively.

It is the cornerstone of your compensation, influencing much more than your take-home pay.

By knowing its components, impact, and how to negotiate it, you gain control.

Use this knowledge to build a secure and prosperous financial future.

Frequently Asked Questions About Basic Salary

How does my basic salary affect my job search, especially with AI screening tools?

Your basic salary expectations matter for recruiters.

AI screening tools check salary ranges to match your expectations with the company's budget.

They match your desired pay with the company's budget.

Knowing your ideal basic salary helps these tools find good job fits.

Can my basic salary change during my employment?

Yes, your basic salary can change over time.

Companies often review salaries each year.

These changes usually come as raises or increments.

Promotions or new roles also lead to a revised basic wage.

Is basic salary the same across all industries for the same role?

No, basic salary varies greatly by industry.

Different sectors have different pay scales.

A software engineer's pay differs between tech and manufacturing.

Always check industry pay rates for your specific role.

How can I find out the average basic salary for my role?

You can use online tools to find average salaries.

These resources provide valuable pay insights.

Here are some places to check:

- Glassdoor: Offers salary data by company and role.

- Payscale: Provides personalized salary reports.

- LinkedIn Salary: Shows salary ranges based on your profile.

Talk to people in your field for more insights.

What's the difference between my basic salary and my CTC (Cost to Company)?

Your basic salary is your fixed, core pay.

CTC, or Cost to Company, is your employer's total cost for you.

It includes your basic pay, allowances, and benefits like health insurance.

CTC is always much higher than just your basic pay.

Are there any legal protections for my basic salary?

Yes, labor laws often protect your basic salary.

Minimum wage laws set a floor for your basic pay.

Your job contract legally guarantees your agreed basic wage.

Contact your local labor department if you have concerns.

How useful was this post?

Click on a star to rate it!

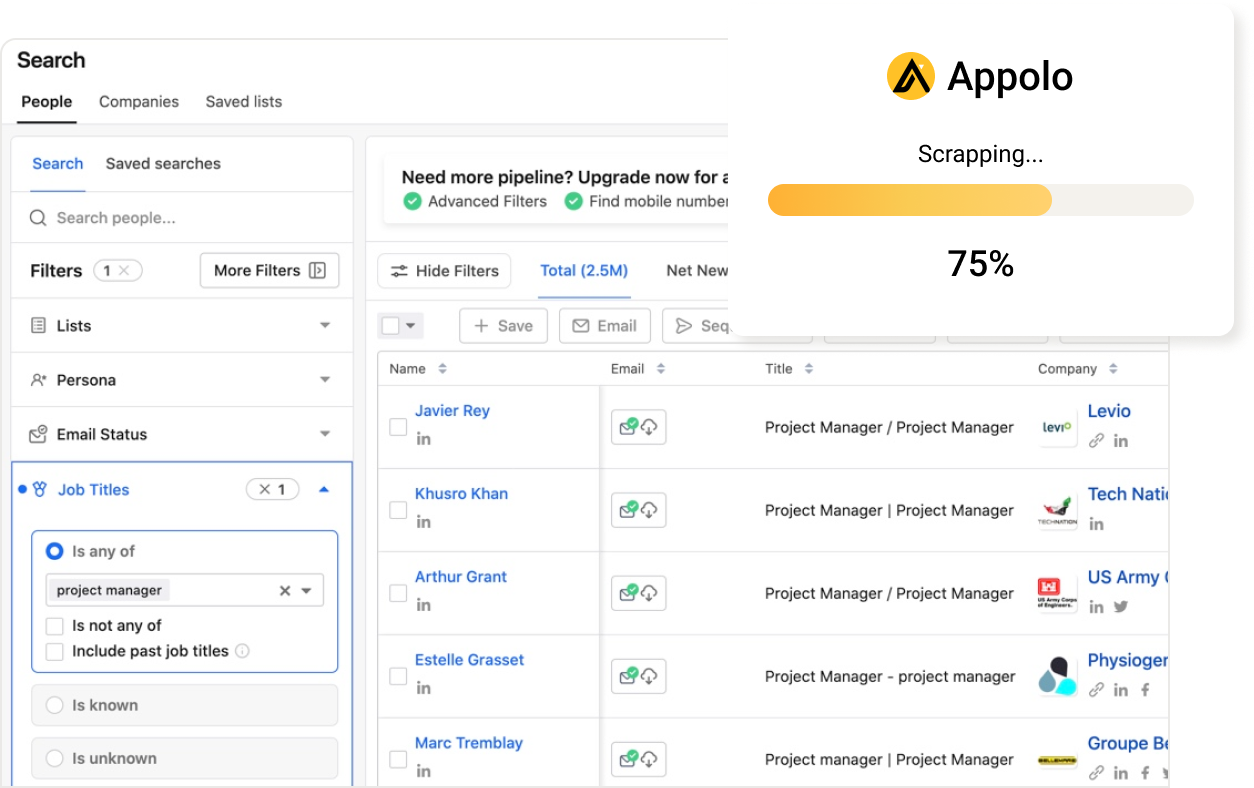

Export Leads from

Sales Navigator, Apollo, Linkedin